Call Today for a Free Quote

Call (877) 501-7243

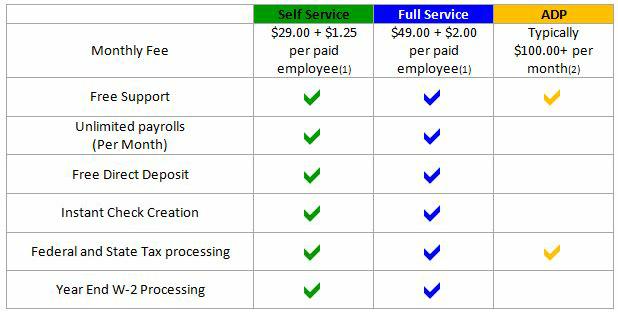

Flat Monthly Rates, No Hidden Charges!

Pricing

Important disclaimers, disclosures and Compare Pricing Notes

1. LowCostPayroll.com standard monthly service includes 1 state. If you file taxes in more than one state, each additional state is currently $12/month. Sales tax may be applied where applicable. Terms, conditions, pricing, features, service and support are subject to change without notice. LowCostPayroll.com can peform year end W-2 Processing for Self-Service Clients for $3.00 per W-2. Workers' Comp audit prep services and Local Tax Filing Services are available for additional fees.

2. Pricing based on 8/09 comparison ofLowCostPayroll.com and Basic vs Paychex small business category and the ADP Small Business Compliance package. Monthly fee based on 1 state for 1 employee running payroll on a bi-weekly basis. With LowCostPayroll.com, you create paychecks yourself and handle tax forms and filings, whereas with ADP and Paychex, the entire payroll processing, creating paychecks and tax forms and filings are handled by ADP and Paychex. Prices may vary by state and number of employees.